Plan

Plan

Execute

Execute

Thrive

Thrive

About Us

Larry L. Davis Jr., CRPC®, AIF®, EA

CERTIFIED FINANCIAL PLANNER™

Office: (586) 930-0039 x700

[email protected]

Larry has been active in the financial planning field since 2004 and is the founder of Davis Capital Management. As a well-known planner in the Southeast Michigan area, he works primarily with small business owners, post-divorce planning, and people transitioning from their working years into retirement. Through his experience he has developed and refined wealth management processes including the PET FORMula™. He is an active member in the Financial and Estate Planning Council of Macomb County and is actively involved with the Rochester Chamber of Commerce. He resides with his wife and three children in Washington Township and feel very blessed to be a part of this community.

Jessica DiDonato

Client Service Associate

Office: (586) 930-0039 x702

[email protected]

Jessica brings with her 10 years of experience managing an office and team of people in the real estate industry. Since joining DCM in 2015 she has been serving our clients with friendly communication and a warm smile. With her attention to detail they are left feeling that all of their service needs have been handled. Jessica resides with her husband and two children in Shelby Township.

Designation Definitions

The CFP® certification is a voluntary certification; no federal or state law or regulation requires financial planners to hold CFP® certification. It is recognized in the United States and a number of other countries for its (1) high standard of professional education; (2) stringent code of conduct and standards of practice; and (3) ethical requirements that govern professional engagements with clients. Currently, more than 62,000 individuals have obtained CFP® certification in the United States.

To attain the right to use the CFP® marks, an individual must satisfactorily fulfill the following requirements:

- Education – Complete an advanced college-level course of study addressing the financial planning subject areas that CFP Board’s studies have determined as necessary for the competent and professional delivery of financial planning services, and attain a Bachelor’s Degree from a regionally accredited United States college or university (or its equivalent from a foreign university). CFP Board’s financial planning subject areas include insurance planning and risk management, employee benefits planning, investment planning, income tax planning, retirement planning, and estate planning;

- Examination – Pass the comprehensive CFP® Certification Examination. The examination, administered in 10 hours over a two-day period, includes case studies and client scenarios designed to test one’s ability to correctly diagnose financial planning issues and apply one’s knowledge of financial planning to real world circumstances;

- Experience – Complete at least three years of full-time financial planning-related experience (or the equivalent, measured as 2,000 hours per year); and

- Ethics – Agree to be bound by CFP Board’s Standards of Professional Conduct, a set of documents outlining the ethical and practice standards for CFP® professionals.

Individuals who become certified must complete the following ongoing education and ethics requirements in order to maintain the right to continue to use the CFP® marks:

- Continuing Education – Complete 30 hours of continuing education hours every two years, including two hours on the Code of Ethics and other parts of the Standards of Professional Conduct, to maintain competence and keep up with developments in the financial planning field; and

- Ethics – Renew an agreement to be bound by the Standards of Professional Conduct. The Standards prominently require that CFP® professionals provide financial planning services at a fiduciary standard of care. This means CFP® professionals must provide financial planning services in the best interests of their clients.

CFP® professionals who fail to comply with the above standards and requirements may be subject to CFP Board’s enforcement process, which could result in suspension or permanent revocation of their CFP® certification.

The Right Fit

I am a wealth advisor primarily for a small group of successful individuals who are five years or less from retirement. Through my experiences these individuals gain the most value from my unique planning process and help answer many large financial decisions. It is within this window of time that your decisions will ultimately impact the rest of retirement. I have a systematic approach that puts all the pieces of the financial puzzle together.

The following attributes of our existing clients’ represent who we are best suited to serve.

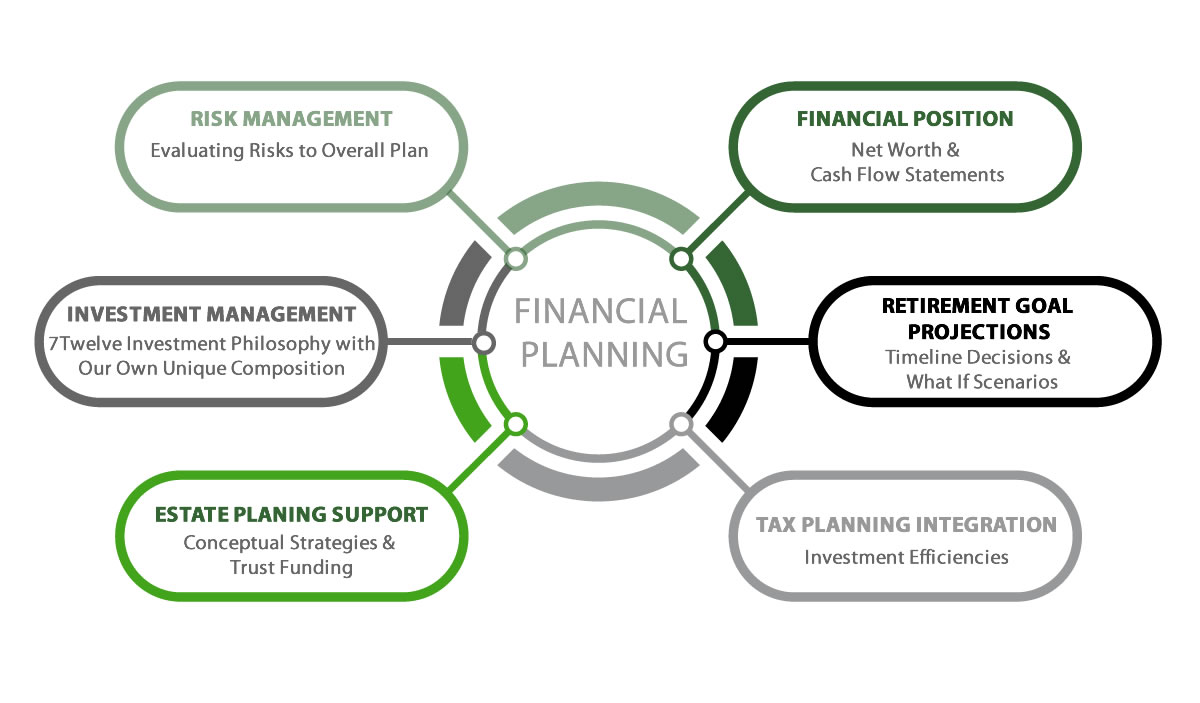

Services

Here is a list for some of the services we provide on a regular basis.

- Risk Tolerance Assessment

- Retirement Map Projection

- Tailored Portfolio Construction

- Ongoing Portfolio Re-Balancing

- Investment Policy Statement

- RMD Reminders

- Regular Due Diligence on Portfolio Positions

- Help with Managing Emotional Investment Decisions

- Bi-Annual Face to Face Review Meetings

- Online Remote Meetings Available

- Additional Investment Research Reports Upon Request

- Monthly Newsletter

- Advice on Assets Held Through Current Employer Sponsored Plan

- Invitation to all Client Appreciation and Educational Events

- Online Account Access

- Personalized Wealth Management Website Through Emoney CMX Platform

- Beneficiary Reviews

- Trust Funding Support

- Automatic Investment Plans

- Evaluating Retirement Plan Contribution Options & IRS Limits

- Tax Efficiency for Non-qualified Accounts

- Professional Financial Organizer Binder

- Comprehensive Financial Planning Reports

Contact Us

Come visit us at the Shelby Business Center; Just north of 23 Mile on Van Dyke.

51424 Van Dyke Avenue, Suite #9

Shelby Township, MI 48316

Phone: (586) 930-0039 Ext. 700 | Fax: (586) 314-2643

Contact Us

Come visit us at the Shelby Business Center; Just north of 23 Mile on Van Dyke.

51424 Van Dyke Avenue, Suite #9

Shelby Township, MI 48316

Phone: (586) 930-0039

Fax: (586) 314-2643